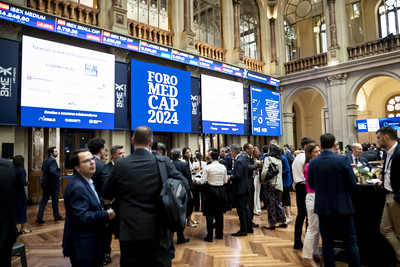

Foro Medcap 20: The Highlights

Attended by more than 100 companies and 180 institutional investors, of which 27% are based outside of the Spanish market, BME’s Foro Medcap Conference, now in its 20th year, took place in Madrid between May 28 - 30. During the three-day event, leading experts shared their unique insights into some of the dynamics driving Spain’s resurgent economy, the growing impact of digitalisation and sustainability on companies, and how the country can make its capital markets more enticing for SMEs.

Spain Leads the Turnaround

After seeing its economy battered by Covid, Spain is now one of the fastest growing countries in the eurozone.

“Spain’s Gross Domestic Product (GDP) grew by 2.4% in 2023, and this trend looks set to continue in 2024. In Q1 2024, Spain’s GDP increased by 0.7%, and the government believes we will close the year on 2%. The European Commission’s (EC) forecasts are more generous, however, with predictions that Spain’s GDP will grow 2.1% in 2024 and 1.9% in 2025,” said Paula Conthe, Secretary General of the Treasury, Ministry of the Economy, Commerce and Business, speaking on Day One of Foro Medcap.

This was echoed by Angel Gavila´n, Director, Economics and Statistics at the Spanish Central Bank, who said that Spain’s GDP growth in 2023 was five times greater than the 0.5% GDP growth registered in the eurozone.

Although Spain’s economy is facing some challenging headwinds (e.g. geopolitical tensions, macro uncertainty, sluggish European growth and doggedly high interest rates, etc.) it has been cushioned by better-than-expected export data and a robust tourism sector, according to BBVA Research.

Spain’s economic resilience has also been facilitated by the country’s falling debt-GDP levels following the pandemic. In December 2021, Spain’s debt-GDP ratio stood at 118.7%, but Conthe said this has since fallen to 107%. “The increase in foreign trade has allowed Spain to reduce its debt, which has resulted in more foreign direct investment,” she continued.

Some argue that Spain’s GDP growth could even exceed expectations, if market conditions are particularly favourable. “If tourism in the country continues to grow and the EU economy reactivates itself following its recent stagnation, then Spain could potentially see GDP growth of 2.5%,” said Mari´a Jesu´s Ferna´ndez, a senior economist at think tank Funcas.

Similar to many other Eurozone economies, inflation in Spain is progressively falling, albeit slowly. According to reports, Spain’s headline inflation currently stands at 3.2% although this is projected to drop to 2.1% in 2025.

Not everyone, however, is bullish about Spain’s economic prospects.

“Between 2019 and 2023, investment in Spain was down 5% and we have seen a 15% increase in public sector expenses. This reminds me of when I went to Athens in 2006 and people there were telling me the country was the engine for growth in Europe,” said Daniel Lacalle, Chief Economist at Tressis, a wealth management and financial services company.

To Succeed, Companies Need to Adapt

If companies are to flourish, then they will need to embrace digitalisation and sustainability, a point made by several speakers during Foro Medcap.

Having been badly disrupted by recent supply chain crises and de-globalisation, In~igo Meira´s, CEO at leading distributor Logista, said logistics businesses generally are investing heavily into digitalisation following the rapid growth of e-commerce. This comes as more logistics companies are having to optimise their operations to meet the increasing demands of tech-savvy retail customers.

Similarly, Constantino Ferna´ndez, President and CEO of software provider Altia, said the digital economy is growing at an exponential pace, with companies prioritising investments into areas such as cyber-security, cloud migration, and more recently artificial intelligence (AI).

“There are very few things that cannot be improved through technology,” added Ferna´ndez.

However, smaller companies, noted Meira´s, are occasionally at a disadvantage when trying to digitalise their operations, mainly due to the sheer costs involved with Research and Development.

A commitment to sustainability is also essential, especially as there is growing empirical evidence suggesting that companies which perform well on Environmental, Social, Governance (ESG) metrics often generate higher revenues.

The role of public-private partnerships in driving ESG projects was also discussed during Foro Medcap. “By combining ICO funding with subsidies from the EC, this has allowed for electric vehicle charging stations to proliferate inside Spain, for example” said Jose Carlos Garci´a de Quevedo, President of ICO, a corporate state-owned entity.

Public Markets Come back to Life

After suffering a 35% decline in issuances in 2023, green shoots appear to be emerging in Europe’s IPO market, with two of the world’s largest listings this year taking place on BME Group and SIX Swiss Exchange.

“A few weeks ago, cosmetics and fragrance specialist Puig made its debut on the BME Group. Together with Galderma, a dermatology specialist, which joined SIX Swiss Exchange in late March, these two listings are the biggest IPOs we have seen so far this year and the largest in Spain since 2015. Other large companies have also announced their intention to debut on the market, so we expect 2024 to be a good year,” said Jos Dijsselhof, CEO of SIX Group.

Regardless, SME listing activity stays slow, driven by several factors.

“In the last few years, we have seen a boom in passively managed funds, which are biased towards larger companies. As a result, the big companies are getting bigger and the small companies are getting smaller,” said Lola Solana, Head of European Small Caps at Santander.

Additionally, increased retail investor engagement in SME IPOs is needed. Although there is nothing preventing retail investors from buying shares in listed SMEs, most people prefer to have exposure to larger, more well-known companies, said A´ngel Benito, Director General of Markets at the CNMV, Spain’s securities market regulator.

Equally, some retail investors may be deterred from investing in SMEs because of their perceived lack of liquidity, at least relative to some of the more sizeable companies listed on the main market.

“One of the reasons we have lost the retail investor segment is because they are overprotected by legislation. Privately placing a product with a smaller group of institutional investors who are familiar with the assets and securities is a more straightforward process,” said Roger Freixes, Partner at law firm Cuatrecasas.

Getting SMEs to Go Public

Efforts to encourage more SMEs to go public are ongoing. Firstly, the SIX Swiss Exchange and BME have both created market segments aimed specifically at SMEs. “In Spain, our SME segment, BME Growth, offers great sectoral diversity. We also run an SME segment on the SIX Swiss Exchange with Sparks. It is important for growth companies to know that the stock market is also open to them, highlighted Dijsselhof.

In addition to the BME Growth segment, the Exchange also runs the BME Scaleup, which is aimed at slightly smaller businesses, namely those with an annual turnover of at least €1 million. “In Spain, we also provide training and guidance to early-stage companies. This complements the Sparks IPO Academy in Switzerland, which is a fast-track programme designed to prepare companies for a potential IPO on the Sparks segment,” said Dijsselhof.

However, it is clear that work still needs to be done by regulators and policymakers to further boost listing activity in Spain. “This is why the BME has drafted a comprehensive white paper looking at ways to make the market more competitive,” said Javier Hernani, CEO at BME Group.

In order to encourage more SMEs to IPO in Spain, the BME Group’s white paper recommends simplifying and streamlining the listing process; maintaining tax incentives under the start-up law when companies begin trading on multilateral trading systems such as BME Growth; and eliminating the requirement for companies to move from a multilateral trading system to a main market when certain capitalisation thresholds are reached.

Investors on Board

Incentivising greater investment into SMEs is also critical if these businesses are to scale. Leading exchanges are playing their part by helping SMEs obtain greater visibility with investors. This comes following the rollout of the EU’s Markets in Financial Instruments Directive II (MiFID II), which forces brokers to unbundle their equity research from their trading commissions - a development that has led to a massive contraction in analysts’ coverage of SMEs.

“The problem with non-covered securities is universal. It is estimated that between 30% and 40% of listed stocks worldwide are not covered by research firms. Thanks to initiatives such as Stage in Switzerland and Lighthouse in Spain, we provide equity research on poorly covered stocks. Lighthouse is a fundamental analysis service aimed at the equity market whereby research coverage is provided for listed securities that are not followed by financial firms,” according to Dijsselhof.

Ensuring that investors can easily access SMEs is a priority for the market. BME’s white paper argues that measures need to be introduced to drive more retail volumes into the local market. One way this could be done is through better education of retail investors, a point made by Manuel Marti´n-Mun~i´o, Director General of financial services firm Norbolsa.

Other recommendations from the white paper include making it easier to invest in listed SMEs through collective investment vehicles; modifying the marketing regime for hedge funds to encourage their use as an alternative investment product for private savings; and encouraging IPOs as a means of divestment for investees of venture capital and private equity firms.

Foreign institutions will also ramp up their holdings in Spanish (and European) companies if post-trade barriers are rationalised in the EU.

“A recent paper by the European Securities and Markets Authority (ESMA) highlighted that Europe has dozens of Central Counterparty Clearing Houses (CCPs) and Central Securities Depositories (CSDs), yet the US only has one,” said Jorge Yzaguirre Scharfhausen, Deputy Head of SIX Securities Services.

Getting Spain to the next level

Spain’s economy – when benchmarked against its European rivals – is in a strong position. To accelerate growth even further, then the conditions for facilitating SME listings and investing need to be improved.

Find pictures about the event here.

For more information, check out the website Foro Medcap.