Diversified exposure to Spanish market

Benefit from the market reference IBEX35® index: a highly liquid underlying

ETFs have opened up a broad array of investment opportunities for institutional and retail investors alike. With one simple trade, ETFs enable investors to get easy and cost competitive exposure to a wide range of asset classes.

ETFs are traded and settled just like any other share on the stock market. Access to liquidity is guaranteed by specialists or market makers who take the public commitment to place constant bid and offer prices on the ETFs under their coverage. These could be index funds, where the investment strategy involves tracking the performance of a certain index (such as IBEX35®).

ETFs are traded in a specific segment of SIBE, subject to specific conditions for this type of products. SIBE provides access to trading and disseminates real-time market information: prices, trading volumes, indicative net asset value, composition of the basket of securities and net asset value. Market statistics are provided on a periodical basis.

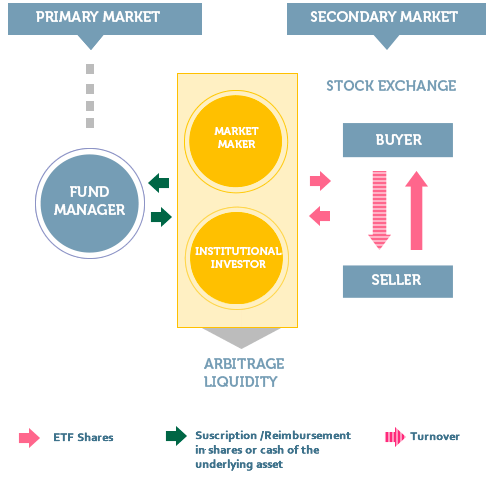

Fund Manager: manages the ETF by calculating the net asset value and keeping the portfolio adjusted to the composition of the underlying index. Only the fund manager can issue and reimburse participations to be negotiated in the market as well as being in charge of promoting the product and disseminating information on the ETF.

The ETFs trading segment counts on the role of the specialist, who fosters the liquidity of the product and eases the dissemination of information and the price formation process. Keeping a maximum spread for a specific volume, specialists allow trading in the secondary market on a price in line with the indicative net asset value of the ETF. Additionally, acting in the primary market, specialists make it possible to have an adequate number of ETF participations in the market. Any security to be negotiated on this segment needs to count on at least one specialist. Depending on the particular features of the ETF, the requisites for the specialist performance regime will be established. These requisites will make reference to the maximum spread between the buying and selling price of the positions submitted by the specialist on the market, to the minimum cash amount of the mentioned positions, and to the performance in the market during the trading session. Simultaneous performance of the specialist on the primary and secondary market allows, through arbitration, a price for the ETF that is levelled with the net asset value.

Market where mainly institutional investors and specialists turn to in order to subscribe and ask for the reimbursement of participations according to the minimum cash amount established by the fund manager.

Market where all type of investors may access and where ETFs participations are purchased and sold like any other security stock.

Trading Hours

Trading session for ETFs starts with an opening auction from 8:30 to 9:00 and continues with an open session from 9:00 to 17:35. The opening auction will have a random end of a maximum of 30 seconds. While no trades may be executed during the auction period, orders may be entered, modified and cancelled. During the auction period, the equilibrium price at which trades would be executed if the auction period ends is available all the time. The price resulting of the opening auction will be the opening price. During the open market, orders can be introduced, modified and cancelled. Orders are matched on a price-time priority.

The closing price for the trading session will be the midpoint between the best buy and sell prices, rounded up. If at the close either the buy or sell price is missing, or the resulting closing price is outside the static range, or the instrument is suspended, the closing price will be that of the last traded price of the session. In the case of a failure to meet all of the previous criteria, the closing price will be the reference price of the session.

The open session may be temporary interrupted by volatility auctions when the price variation limits are exceeded. The duration of the volatility auctions will be of five minutes with a random end of a maximum of 30 seconds.

The trading hours for the block trading will be from 9:00 to 17:30h. The market for special operations will be open from 17:35 to 20:00h.

Opening Auction: from 8:30 to 9:00 h.

Opening Session: from 9:00 to 17:35 h.