The Extended Custody Services of BME offer multiple services aimed at entities, issuers, and clients that need a provider of technical resources to develop activities related to post-trading, corporate event management, or financial communication.

Services and Solutions

The services we provide take advantage of the experience, strength, and security that characterize BME as an operator on Spanish market systems and infrastructure.

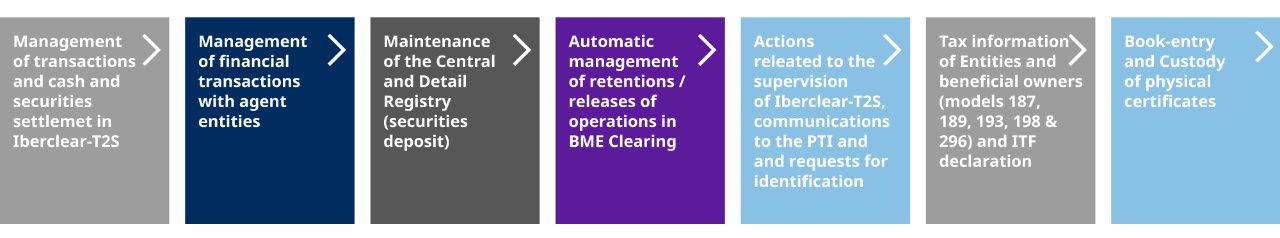

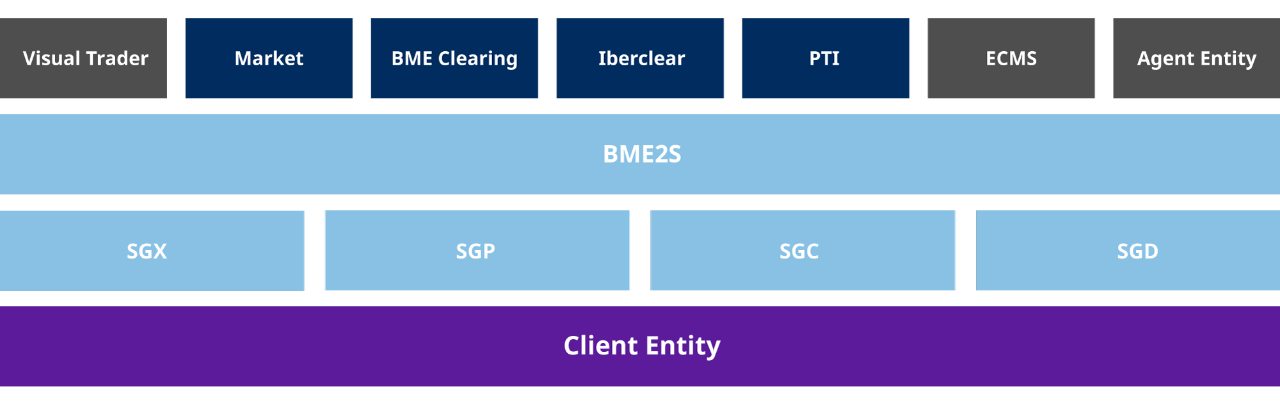

BME Securities Solutions (BME2S) offers approved technical resources to market and BME Clearing members and Iberclear participating entities.

This solution allows the client to outsource infrastructure connection services and operational compliance in settlement and custody activities.

Advantages:

- Maintaining client independence and control

- Flexibility in the degree of system performance

- Flexibility in the handling and notification of data and instructions

- Compliance with the technical infrastructure requirements:

- Market

- BME Clearing

- PTI

- Iberclear-T2S

BME2S offers the alternative that provides the client with full independence with respect to any regulatory, legal, or technical changes, since they will be fully covered by the platform, in a fully transparent manner vis-à-vis the client.

BME2S Technical Platform Modules

- SGP

- SGC

- SGD

- SGX

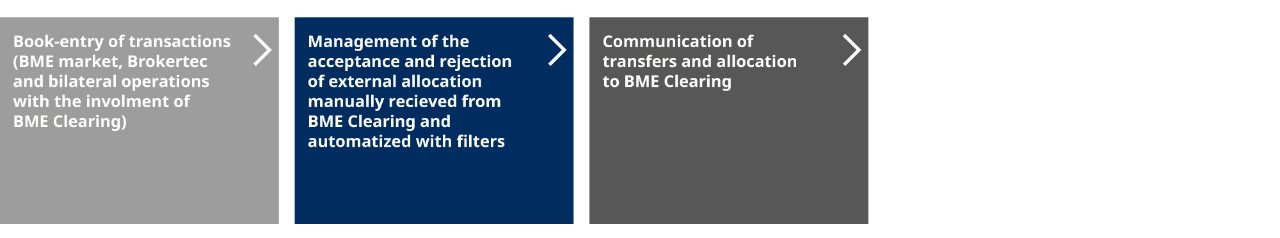

Post-Trading Management System (SGP) – Market Members

The Post-Trading Management System provides the market member with main functions, such as:

- Execution and transaction register

- Linking transactions to the shareholder

- Internal and external allocations in BME Clearing (automated)

- Calculations and management of the Settlement and brokerage fees and the FTT

The system also interacts with the other two BME2S management systems: the Clearing Management System (SGC) and the Custody Management System (SGD), as well as with Visual Trader (Inntech).

We offer the outsourcing of the administration and management of connectivity to the SWIFT network through:

SWIFT Engine

Provides entities with connectivity to the SWIFT network through the outsourcing of the entire infrastructure, which provides support in service mode and the use of the SWIFT Hub components of BME and the SIX Group.

BME Highway

The service provides all types of companies with the technical means for connectivity to the SWIFT network, thereby enabling banking notification and guaranteeing the integration of the company’s financial messaging with its treasury management software or ERP.

The Corporate Events Service (EVCO) offers technical resources and support to Agent Entities in holding corporate events, as well as advice on its planning. Manages all types of events relating to securities registered in Iberclear: capital increases, IPOs, flexible dividends, exchanges, etc.

EVCO is also in charge of the technical coordination of notifications with participating entities, as well as with market infrastructures.

Capital Increases, Fixed Income Subscriptions, Fixed Income Swaps and Conversions

- Preparation of a budget

- Design of the rules to be followed for reporting trade data

- Receipt of IT support and automated data processing

- Preparation of the dissemination tables to be submitted to the CNMV

Takeover Bids, Public Offers for Sale or Subscription

Collaboration in the publication of the corporate event and the corresponding circular

- Coordination and reception of all transactions and management of derived orders.

- In public offers for sale or subscription, issuance of documentation adapted to each transaction.

- Notifications to the CNMV.

- In the case of takeover bids, publication of the result in the Daily Bulletin.

The Accounting Register of Book-entry and the Shareholder Register Book service offer technical support for keeping the book-entry record of unlisted securities as well as the register book of shareholders, both of securities admitted to trading on a regulated market or multilateral trading system, and unlisted securities with the book entry record in Iberclear.

Company managers can use their own terminals to consult individual shareholder information, including the current position and historical changes, as well as aggregated information by nationality, percentage of capital, etc.

We offer issuers two registration services:

Book-Entry Accounting Register

Enables the issuing company or the management company to record all transactions in order to know, in detail, the information that identifies the company’s shareholders.

Features and benefits

- Exclusive access to real-time information

- Accurate, current, and historical information on the owners of the securities

- Generation of complementary reports

- Exhaustive detail concerning each annotation

- Immediate registration of transfers

- Control of financial transactions

- Technical and legal certainty in assigning ownership

- A prerequisite for a subsequent IPO

- Disappearance of physical titles with the consequent cost reductions.

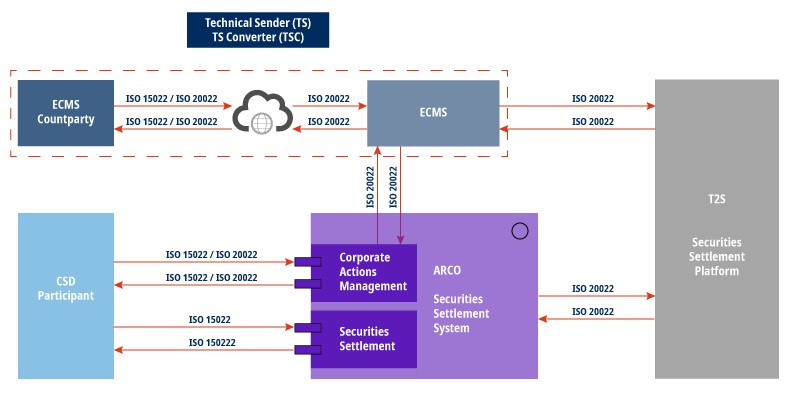

This BME service facilitates the exchange of messaging between subscribing entities and the ECMS (Eurosystem Collateral Management System) platform for the management of collateral for monetary policy transactions with the Eurosystem.

Technical Sender acts as an operations center, assuming development, notification, and control functions of the different elements that make up the system. This enables compliance with the technical requirements of security, continuity, and contingency.

It offers two levels of service:

Technical Sender (TS)

Basic message routing service.

TS Converter (TSC)

Routing service with conversion of messages between different standards.

Message Categories Used by ECMS

- Corporate Actions

- Securities Settlement

- Securities Management

- Payments

- Margin Call

- Collateral Management

- Cash Management

- Credit Claims

- Credit Freezing

What Entities Are Our Extended Custody Services Intended For?

|

Services |

Intended For |

|---|---|

|

Shareholder Register |

Issuers / Managers / Participating Entities / Market Members |

|

Book-Entry Accounting Register service |

Issuers / Managers / Participating Entities / Market Members |

|

Corporate Events |

Agent Entities |

|

BME2S – Post-Trade Management System |

Market Members |

|

BME2S – Clearing Management System |

BME Clearing Members |

|

BME2S – Deposit Management System |

Participating Entities |

|

BME2S – Static Data |

Market Members / Participating Entities / BME Clearing Members |

|

BME HighWay – SWIFT Engine |

Market Members / Participating Entities / Managers / Banks |

|

BME HighWay – Companies |

Companies |

|

Technical Sender / Converter |

Participating Entities / Banks / Counterparty entities in ECMS / Central Securities Depositories |