After almost a year of work, and in order to improve the IPO and public offering processes for initial admission to trading on a stock exchange and accelerated bookbuilds for newly issued shares issued as part of a capital increase, BME offers issuers the possibility of applying a T+1 settlement cycle to these types of transactions ((i.e. one day after the transaction). However, it remains possible to continue to settle these transactions on a T+2 settlement cycle.

On 15 November, this new procedure was applied for the first time in production, successfully settling the first admission to trading on the stock exchange under a T+1 settlement cycle in the Spanish market. This was on the occasion of the listing of Cox, a company in the water and energy sector, which made an Initial Public Offering (IPO) for a value of 175 million euros at a final price of 10.23 euros per share, applicable to 17,106,549 newly issued ordinary shares subscribed in the Offering. The settlement on D+1 was successful and marked a milestone in the Spanish market.

The main advantage of the shortened settlement cycle is that the pre-funding supporting the issue of the new shares issued is reduced by one day, i.e. the pre-funding that takes place between their disbursement and the settlement of the offer. At the same time, the new procedure preserves the security and efficiency that stock market transactions bring to all those involved in this type of operations.

In simplified terms, the following table shows the current procedure for the execution and settlement of public share offerings and accelerated bookbuilds following a T+2 settlement cycle.

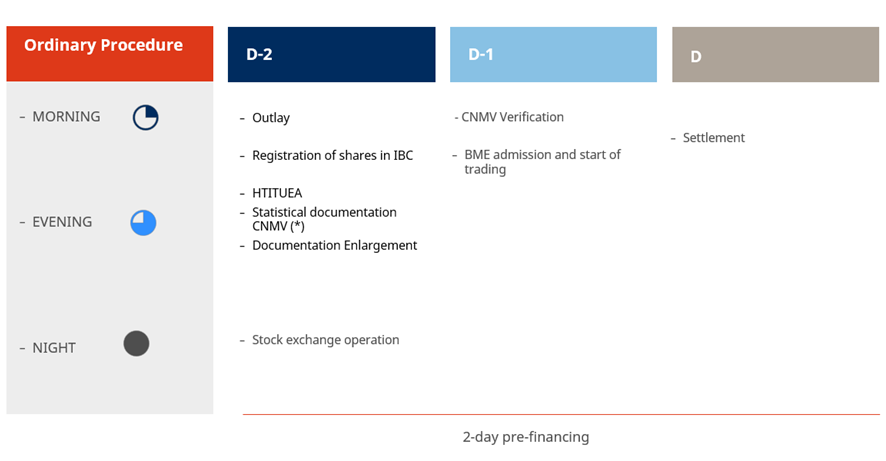

Likewise, the following table reflects the new procedure for the execution and settlement of public offers for subscription and sale of shares and accelerated bookbuilds following a T+1 settlement cycle.

This procedure can be considered in the Spanish market as the prelude to the upcoming harmonization of the European markets with the American market which, since May this year, has been settling its securities trades according to a T+1 settlement cycle. Europe is working to implement the shortening of the settlement cycle, foreseeably by the end of 2027. This new feature offered by BME is not part of this general market transformation process, but it can be considered as a first step given the technical adjustments that have had to be made.